Your company’s contingent workforce is both a business necessity and a potential liability risk, with no relief in sight.

Three months into the Trump Administration, the U.S. Department of Labor has not changed its guidance that “most workers are employees under the FLSA’s broad definitions” or withdrawn from its cooperative enforcement agreements with the IRS and 37 states. The EEOC’s 2017 to 2021 strategic plan identifies independent contracting as “a new priority to address.”

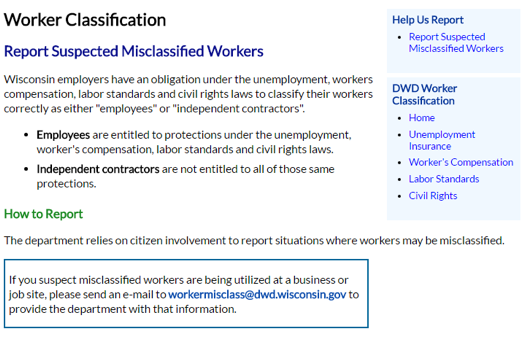

To further the complexity, state agencies still have ongoing campaigns against IC misclassification. Pennsylvania’s GetClassified.pa.gov declares, “Worker misclassification is a nationwide problem that has a negative impact on Pennsylvania’s economy and unemployment compensation fund, and it creates an uneven playing field for employers who properly classify their workers.” Wisconsin’s website invites individuals to send an email to workermisclass@dwd.wisconsin.gov to “report suspected misclassified workers.” In addition: Connecticut, Illinois, Iowa, Maine, Maryland, Massachusetts, Michigan, Minnesota, New Hampshire, New Jersey, New York, Ohio, Oregon, Rhode Island, Utah and Vermont all have created enforcement task forces of IC misclassification.

Labor unions and other advocate groups have successfully lobbied for new legislation and regulations to make independent contracting more difficult, such as New York City’s “Freelancing Isn’t Free” ordinance providing double damages if contractors are not timely paid and a Seattle ordinance allowing for-hire drivers to unionize.

The plaintiffs’ bar is increasingly active filing cases and stacking up the wins for unpaid overtime, employee benefits, unemployment insurance and other federal and state laws on behalf of drivers, cable installers, installers for retailers, fitness instructors, commercial painters, energy workers, aircraft maintenance workers, freelance writers and bloggers, mailroom workers, cheerleaders and exotic dancers.

If your company has a contingent workforce, to avoid misclassification you can benefit by knowing the risk factors and pre-screening your contractors.

Risk factors for misclassification include engaging contractors who:

- Are former employees;

- Perform the same work as employees;

- Do not perform work for any other company;

- Does not have a tax employer identification number (TEIN); and/or

- Do not own the tools or equipment necessary to perform the work.

Additional risk is created if your company:

- Engages 1099 workers to perform work that is essential to the business;

- Controls where, when and how work is performed;

- Reimburses the contractor for business expenses;

- Requires contractors to sign a non-compete;

- Provides training to contractors; and/or

- Pays contractors by the hour or a salary, rather than by the job.

ComplianceHR’s Navigator IC application can help you with the time-consuming and confusing screening of contractor and company risk factors. It rapidly applies complex logic based on Littler’s analysis of the facts that courts found most important to determining independent contractor status in more than 1,500 reported cases. Contact us at support@compliancehr.com if you would like a demo of the Navigator IC application to learn more about how you too can begin to enjoy the benefits of assessing risk for your contingent workforce.