Complying with the minimum wage regulations should be easy, but it is not. Finding the correct state, county or city minimum wage – and tracking the ongoing increases in those minimum wages can take hours.

Employers are required to pay non-exempt employees at the highest applicable federal, state or local minimum wage for all hours worked. Twenty-nine states and the District of Columbia now have minimum wages higher than the federal $7.25 per hour. Cities and counties in 14 states now have minimum wages higher than their state minimum wages. Recently, new local minimum wages were enacted in Flagstaff AZ, Polk County IA, Milpitas CA and San Leandro CA.

State and local minimum wages can differ by size of employer, zip code, industry and whether the employer provides health benefits. To add complexity, state and local minimum wages can increase automatically and at different times of the year. In the month of January 2017 alone, a total of 40 states and jurisdictions across the country raised the minimum wage.

In California, in addition to the state wage, there are 23 California cities and counties with their own local minimum wages. The most complex minimum wage law probably goes to Seattle, with New York City a close second. The minimum wage for Seattle depends on:

- The size of the employer

- Where the employee works (Tacoma, Seattle, the Seattle airport or elsewhere);

- Whether the employer is a hotel, restaurant or transportation employer;

- Whether the employer is franchise; and

- What level of medical benefits the employer provides to its employees.

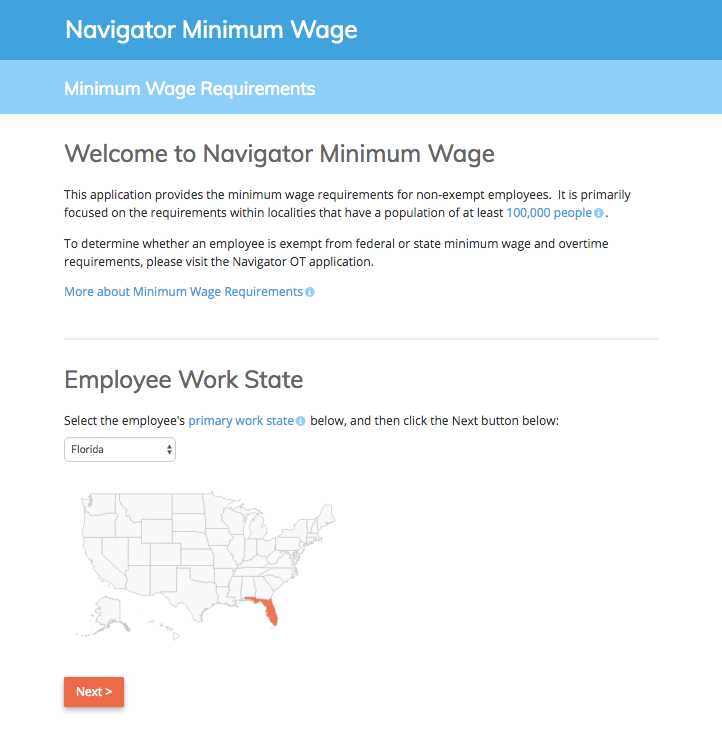

ComplianceHR developed Navigator MW as the answer to your minimum wage compliance challenges. It only takes minutes, rather than hours, to determine the current, correct and applicable minimum wage. Find out how easy it is to find the correct minimum wage using Navigator MW.

To learn more about Navigator MW or schedule a demo, please contact us at info@compliancehr.com.